Core Foundations

Enterprise Risk Management that brings clarity to complexity

Identify, assess and monitor risks across your entire organisation with complete visibility and control.

Trusted by hundreds of clients globally

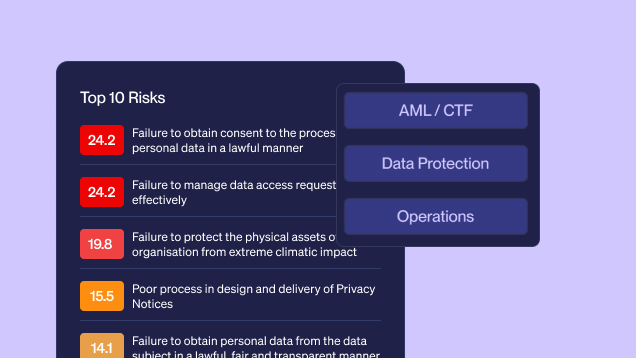

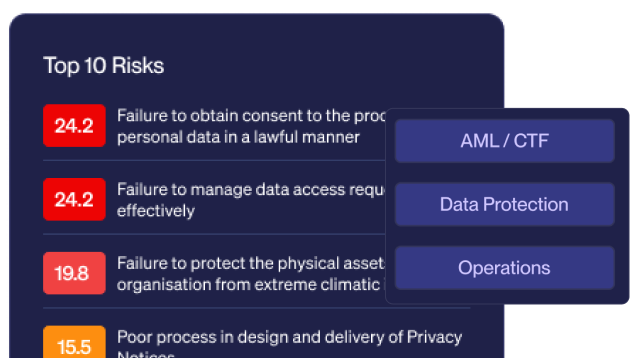

Master enterprise-wide risk

Gain complete visibility across your risk universe with clarity, consistency and real-time intelligence.

Report at the click of a button

Generate tailored reports on risks, controls and more with a single click.

Track tasks and accountability

Assign and track remediation actions across your team ensuring nothing slips through the cracks.

Streamline internal controls

Use pre-populated libraries to map risks to controls, assign ownership and track control testing.

Configure without coding

Tailor structures and alerts to your exact needs using powerful no-code configuration options.

Roles

Related roles that benefit from our platform.

From risk professionals to executive leadership, enterprise risk management provides critical visibility and control across your organisation.

Next Steps

Ready to elevate your approach to ERM?

Schedule a 30-minute platform walk-through with our expert team.