Ready to elevate your GRC platform?

Schedule a 30-minute platform walk-through with our expert team.

Meet DORA compliance requirements with comprehensive ICT risk management, incident reporting and third-party oversight - all in one platform.

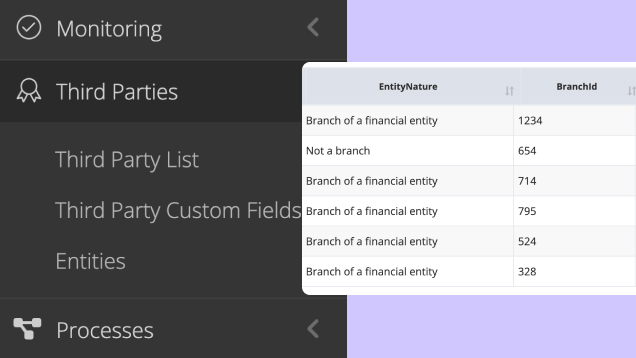

Generate a regulator ready Register of Information at the click of a button

One platform to power every step of your vendor lifecycle - from initial due diligence to offboarding.

Gain complete visibility across your risk universe with clarity, consistency and real-time intelligence.

Build, maintain and automate a robust operational resilience programme.

Launch quickly with pre-built templates and workflows that deliver immediate value from day one.

Using calQrisk, Atlantic Aviation Group's compliance system is 90% paperless with live compliance and safety trend reporting. It's transformed our compliance management.

Joe Martin, Quality Manager at Atlantic Aviation

Schedule a 30-minute platform walk-through with our expert team.